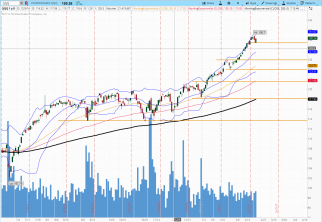

As we see in charts of $QQQ and $SPY we have broken all time high with $DIA as leader last week. But on Friday (june 9) when markets had a significant move down we have seen that $DIA had a green day, from this reason we can say that now, $DIA, is the strongest segment in the market. Maybe we see a rotation of capital out from NASDAQ (growth companies) to $DIA if $QQQ will continue to underperform $SPY and $DIA.

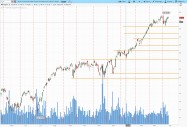

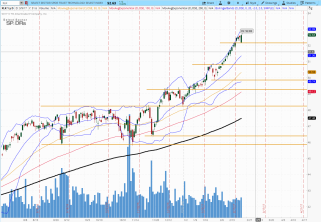

$SPY :

The prior pivots for this week are $245.01 and $242 . As long as SPY holds $242 stay bullish and watch for follow through to clear all time high.

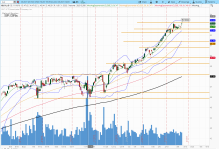

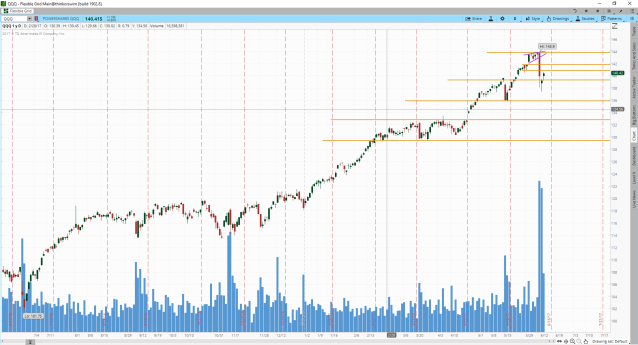

$QQQ :

The prior pivots for this week are $143.90 and $137.48 . If bears want to continue they need to step in somewhere around $142 or $140.85 making a new downmove to $136. If they fail we may see new all time hi.

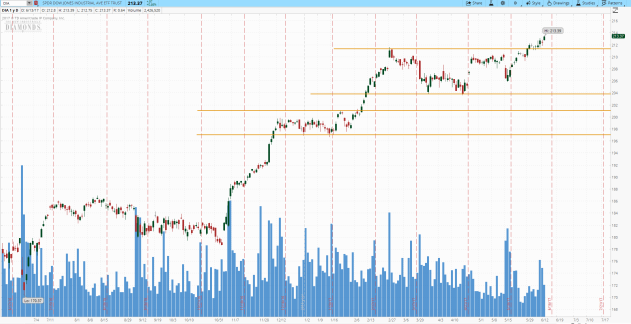

$DIA :

The prior pivot for this week is $211.25 . As long as DIA holds $211.25 stay bullish and watch for follow through, but be patient if move will be too fast because we can enter overbouth zone somewhere around $214-$215.